As an aside to yesterday's post, here's the mental model I am using for the industry this week.

Thursday, April 29, 2010

A picture worth significantly less than 1000 words

Posted by

Jerry Neumann

at

11:41 AM

0

comments

![]()

Labels: Advertising

Wednesday, April 28, 2010

Who Invests in Quantitative Marketing Companies?

About a month ago Jay Yarow wrote about the financing of The Trade Desk. One of the commenters insisted that only Redpoint, Union Square, Highland, Sequoia or First Round Capital were expert enough to invest in online marketing firms. I think this is wrong-headed (and not just because I was one of the investors listed in Jay's article.) But, my opinion aside, what's the truth?

To find out, I made a list of some 150 display-ad companies by flipping through AdExchanger.com*, adding a few companies that exited early and then discarding agencies, ad networks, ad ops and rich media companies**. Of these, only those that had VC investors listed in the Crunchbase database are in the final results***. There were 90 of these.

I also split the list into five general categories: buy-side (19 companies), sell-side (20), marketplace (8), targeting (30), and measurement/verification (13). Each company was put into only one sector, unrealistic as that is.

So, what jumps out?

1. Number of Investors

There are a lot of different investors. I counted 200 institutional investors in the 90 companies.

2. Number of Investments

Most investors have one investment in the sector.

There are 154 investors with one investment, 27 with two, 12 with three and seven with more than three.

The top seven:

- First Round Capital, with 11

- Accel Partners, 9

- Union Square Ventures, 6

- IA Ventures, 5

- DFJ, 5

- SVB Financial/Silicon Valley Bank, 5

- Redpoint, 5

3. Most Diversified

Many of these firms have invested in more than one of the five broad sectors.

Here's a table of the most diversified.

| Buy | Sell | Target | Market | Measure | |

| Accel Partners | ✔ | ✔ | ✔ | ✔ | ✔ |

| First Round Capital | ✔ | ✔ | ✔ | ✔ | |

| Union Square Ventures | ✔ | ✔ | ✔ | ✔ | |

| Draper Fisher Jurvetson | ✔ | ✔ | ✔ | ||

| Redpoint Ventures | ✔ | ✔ | ✔ | ||

| DAG Ventures | ✔ | ✔ | ✔ | ||

| Institutional Venture Partners | ✔ | ✔ | ✔ | ||

| Mayfield Fund | ✔ | ✔ | ✔ | ||

| Menlo Ventures | ✔ | ✔ | ✔ | ||

| Mohr Davidow Ventures | ✔ | ✔ | ✔ | ||

| SVB Financial Group | ✔ | ✔ | ✔ | ||

| Coriolis | ✔ | ✔ | ✔ |

4. The Truth?

What makes an investor a desirable investor in a sector? Time spent on the board of similar companies certainly counts, as does number of non-competing investments in the sector and adjacent sectors.

Under these criteria, USV, First Round, IA Ventures, DFJ, Redpoint, and Accel all stand out.

But another criterion is deal flow, the number of deals an investor looks at even if they don't invest. This sort of activity gives them a good view of the market, and a great network of potential partners. The deal flow criterion is harder to measure. My sense, from talking to entrepreneurs in New York, is that the investors who have talked to the most entrepreneurs in the sector are First Round, IA Ventures, Founder's Collective, NYC Seed, Genacast, WGI/Point, Coriolis, True Ventures, USV, Greycroft, and Spark.

I've worked with or co-invested with most of these investors. I respect their opinions and, if an entrepreneur tells me that one of them is interested, it influences me. But I don't always think they're right. Sometimes one of them likes a company I don't and sometimes I like a company they don't. None of them are always right and none of them make any investment a sure thing.

Given all the uncertainty about which companies will be successful and which won't, the predictive quality of who the investors are is too small to notice. Picking out five or six and dismissing all the others is silly. If you're an entrepreneur, talk to as many as you can and find the one that is best for you, no matter where they work.

---------

* I had a conversation with Greg Hills a few months ago where I asked the metaphysical question of who is quantitative marketing and who is not and he averred that the community is essentially self-defined by who are mentioned in, contribute to or comment on AdExchanger. I think this is as good a screen as any.

** Some of these should logically be included in 'quantitative marketing', but figuring which would take more time than I'd be willing to spend. If anyone wants to volunteer a list, feel free. Or, if anyone wants my hacked-together python scripts so they can do it themselves, let me know.

*** Crunchbase data is a bit funky. I amended it where I knew off the bat it was wrong, but didn't dig into every investment or investor. I am sure the data in this post is incomplete.

Posted by

Jerry Neumann

at

5:43 PM

4

comments

![]()

Monday, April 19, 2010

How to completely disappear in 45 minutes or less (at least from marketers)

Just been reading the FTC complaint against... well, against everyone I know, it seems: the exchanges, the DSPs, the data targeters, the ad agencies, the analytics companies, the whole quantitative marketing shebang. It was pretty straightforward, quoting everyone's marketing material, making the industry seem much, much larger than it actually is*.

Ed Zimmerman has a much better response than I could write, so I'm not going to critique the thing, but one paragraph really jumps out at me.

The value of user data harnessed by these platforms and services is generating higher returns for marketers. Publishers, ad agencies, and marketers are all trying to capitalize on the data of each consumer--thereby causing that consumer a financial loss. None of the so-called consumer benefits of real-time targeting--the "faster loading times" for an ad and whether they provide a "better user experience make up for this financial loss. The availability of so-called free content is an insufficient return to a consumer for their loss of privacy, including their autonomy.The first sentence is interesting because I doubt it is, in general, true, or will ever be. If RTB and its ilk make the whole system more efficient, it is not the marketer that will garner the efficiency. Economics tell us that the main beneficiary will ultimately be the consumer.

The rest of the paragraph is a bit murky and illogical until the last sentence: targeting is corrosive of privacy and autonomy. Long-time readers will know that I don't disagree with this sentiment.

But I've become a bit cynical about consumer privacy. Having been involved in a failed bid to create a product that would safeguard consumer data while allowing marketers to compensate the consumer to use the data, I don't believe that consumers really care enough about their privacy to actually do anything about it. Even the most ardent complainers about the intrusiveness of advertising won't spend more than a few minutes of their time protecting their privacy. This says to me that their privacy is worth nothing to them (but complaining about it is worth something, I think.)

If you really care enough to spend a few minutes, you can do something about it:

- Opt-out of behavioral targeting (NAI)

- Opt-out of telemarketing (Do not call)

- Opt-out of direct mail and other direct marketing (DMA)

- Opt out of the credit bureaus mailings (Experian, Equifax, Innovis, Transunion)

- Opt out at the big data collectors (Axciom, Intelius and Choicepoint)

* It also highlighted the importance of AdExchanger.com, who was cited as a source of industry info in at least half the footnotes.

Posted by

Jerry Neumann

at

5:29 PM

8

comments

![]()

Labels: Advertising

Tuesday, April 13, 2010

The End to End Principle in Ad Exchange Design (The Thin Exchange, 2)

Where should decisions about which ad runs where be made? Ajay Sravanapudi, in his recent article on AdExchanger says

a DSP is really just a feature on an exchange... A DSP simply uses [RTB API] of an exchange to buy media and run campaigns more effectively. The exchange has an ad server that can deliver campaign pacing, frequency capping, targeting, etc. All that is missing is some intelligence to “auto-magically” buy media on behalf of the campaign... Dozens of ad networks have done this for years on things like YieldManager on the RightMedia Exchange (RMX). If we can simply layer this “auto-magical” intelligence on the exchange then there is no need to pay for a DSP.I disagree. There's a sort of businessman's view here, where an intuition about power leads to an answer at odds with systemic efficiency.

Exchange 1.0 did not sell real-time. So the exchanges had to have rules in-system. Like the NASDAQ (and other limit order book markets), the exchange hosted the rules about who wanted to buy and who wanted to sell at any given price on any of the thousands of things traded there.

But RTB ad exchanges don't have thousands of things being traded, they have an almost unlimited number of things. Each ad impression--the placement, the context, the viewer--is different than every other. There is no commodity, so there can be no order book.

With an order book, the commodities had to be limited: i.e. "if the ad presented is on the front page of CNN.com, and the person viewing the ad is a male 18-34 years old, then bid $5.00 per thousand." That doesn't work when the ad presented is a photo of a red flower on Photobucket presented to a non-logged in 33 year old male in Northern New Jersey at 12:13am on a Sunday and who searched for gardening tools at an online retailer yesterday but didn't buy anything and whose circle of acquaintances includes several people who bought sunglasses this week." What ad you put in front of this person and at what price is a difficult problem, not one that can be reduced to simple rules.

The only way to move away from rule-driven trading is to use algorithms. On the buy side, developing the right algorithm requires a ton of experience, a ton of data from live campaigns (and the insight into how well each individual impression worked), a huge amount of experimentation, mathematical savvy, and a dose of genius. On the sell-side the algorithms are even more complicated to develop. The algorithms are where the intelligence is.

Where should these algorithms be run? Here's an analogy. Let's say you wanted your computer to run the algorithms. Where do you think they should be coded? In the operating system? Of course not. In the application layer? Almost certainly not. Obviously, you'd code them as routines to be run by a more general application, like Excel. The lower down the stack, the more generic the functionality should be. This is called the End to End Principle:

Using performance to justify placing functions in a low-level subsystem must be done carefully. Sometimes, by examining the problem thoroughly, the same or better performance enhancement can be achieved at the high level. Performing a function at a low level may be more efficient, if the function can be performed with a minimum perturbation of the machinery already included in the low-level subsystem, but just the opposite situation can occur – that is, performing the function at the lower level may cost more – for two reasons. First, since the lower level subsystem is common to many applications, those applications that do not need the function will pay for it anyway. Second, the low-level subsystem may not have as much information as the higher levels, so it cannot do the job as efficiently.Saltzer, Reed and Clark in "End to End Arguments in System Design". This paper described an idea that has been central to internet architecture since early days: don't put in the center what can be done at the edges. Similarly, David Isenberg's "Rise of the Stupid Networks" (predicting that the internet would beat out the "smart" telecom nets.)

Okay, I can hear all you adtech gearheads: is the exchange really "low" level? It's probably the most complicated piece of software in the whole ecosystem.

But low-level in this argument really means that the functionality is used by the most end-user applications. It has nothing to do with how close to the hardware the function is (the two are correlated, but that's outside my scope.)

Clearly the exchange has the functionality that is shared by the most end-users. Each agent is different: different approaches, different algorithms, different in ways none of us has yet imagined. Why should we attempt to encode this as-yet-undetermined difference into the exchange? Putting DSP functionality into the exchange simply means that everyone has to pay for it, even if they don't use it. This means that other, better ways to be a DSP do not get developed, because then the customer has to pay twice: once for the DSP's DSP and once for the exchange's DSP.

Clearly the exchange has the functionality that is shared by the most end-users. Each agent is different: different approaches, different algorithms, different in ways none of us has yet imagined. Why should we attempt to encode this as-yet-undetermined difference into the exchange? Putting DSP functionality into the exchange simply means that everyone has to pay for it, even if they don't use it. This means that other, better ways to be a DSP do not get developed, because then the customer has to pay twice: once for the DSP's DSP and once for the exchange's DSP.And this brings me to my real beef with the idea that DSP functionality should be built into the exchange, or that any functionality outside of what is absolutely necessary should be built into the exchange. The internet has been so phenomenally successful because the low levels are bare boned and flexible. HTTP, FTP, POP, SMTP, DNS, IMAP, etc. have all been built on top of TCP because TCP does nothing but transfer data from one place to another. It doesn't have much expectation about what that data is or what it should do. If the internet's designers had made TCP more "intelligent", we probably would have never had the Web or Skype. Building low level functionality that is simple and allows layers to be built on top enables innovation. And heaven knows what we need right now in interactive advertising is some innovation.

I don't think the ad exchanges should layer in "auto-magical intelligence." I don't think they should layer in anything. I think they should start dumping functionality like Carl Fredricksen tossing furniture out of his house. The ad exchange should do three things. It should do them fast, it should do them cheaply and it should do them six-sigma. What the ad exchange should do, and all it should do, is cookie-match, cross and clear. The ad exchange should be thin, and as dumb as possible.

Posted by

Jerry Neumann

at

1:20 AM

6

comments

![]()

Labels: Advertising

Sunday, April 11, 2010

Everybody's an ad exchange (The Thin Exchange, 1)

Everybody's a DSP? Everybody's a marketplace.

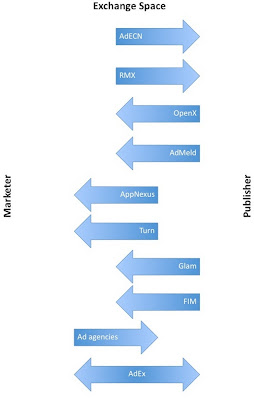

There's this confusing moving about in the marketplace. AdECN was a pure exchange, and is now part of a publisher. Right Media, same thing. OpenX was a publisher tool, and is now running an exchange. AdMeld similarly. AppNexus was an exchange and is now a DSP (I think.) Same with Turn (who was first an ad net before raising money to become an exchange.) Glam and FIM are publishers and now have some features of an exchange. Several of the ad agency holding companies are making unlikely noises about building their own tech. And AdEx, well... they're doing pretty much everything.

It was so confusing I made a picture of companies moving about. A good entrepreneur will change strategies as they learn the lay of the land. But some companies who weren't exchanges are becoming exchanges and some companies who were exchanges are becoming something else so, um, how does the land lay?

A good entrepreneur will change strategies as they learn the lay of the land. But some companies who weren't exchanges are becoming exchanges and some companies who were exchanges are becoming something else so, um, how does the land lay?

Here's what I think:

- The ad exchanges know that running a marketplace should not command what they are charging, and lie awake at night fearing that their customers might someday come to the same awful conclusion.

- The customers already have.

Why is everyone becoming an exchange? Because it's just not that hard to add exchange-like functionality and escape the 20% transaction fees being levied by Google et al. An exchange is a low marginal cost, high fixed cost system. Once you've built the system, you just need to amortize the cost over a sufficient volume. That means that anyone with good volume is better off building their own than paying someone else.

If you extend this economic logic into the future, you arrive at an inevitable conclusion. Someday, someone will garner a huge amount of volume by offering exchange services at the lowest possible price, somewhere just north of marginal cost, probably in the 1% to 5% range of transaction fees. Everyone else will find that it is cheaper to use this single exchange than it is to run one themselves. Non-exchanges will stop reinventing the RTB wheel. And exchanges will be glad they moved into other lines of business.

Posted by

Jerry Neumann

at

11:38 PM

9

comments

![]()

Labels: Advertising