I couldn't sleep last night so I figured I'd see if I could confirm a nagging suspicion about the early-stage VCs I know. About six months ago it seemed like they were slowing down their pace of investing while the corporates and newer super-angels were doing a lot more deals. If this were true it would be an interesting warning sign.

So I downloaded d3.js, pulled out the list of VCs I put together for VCdelta and built a visualizer for Crunchbase data. It's fun to play with*.

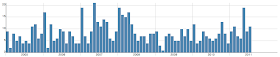

Here's a graph of the deals the 150+ VCs have done since 2005, according to Crunchbase. If you go to the site and click "All" at the bottom, you get this, except it's live to add and subtract either VC firms or round types from and you can hover over the bars and see the names of the companies invested in that month**. You can also, if you click the subsets below, see who I included and who I didn't. And then add or subtract to your heart's content.

What looks like a small downturn in 2008 and 2009 in deals done is mainly due to VCs continuing to do later rounds--B and later. I assume many of these were into companies that were already portfolio companies.

Here are all the VCs, but just the rounds tagged Seed, Angel and A.

This makes it easier to see the dropoff in 2008 and 2009. But the low point in early stage investments came later than I thought, in 2009. It had seemed to me that early 2008 was dryer. Also, according to Crunchbase, more early stage deals are getting done now than in 2007.

New York City is on a roll, right? Right. Below are the NYC funds (not NYC deals) and how many early stage (Seed, Angel, A) deals they did.

Compare this to Sand Hill Road:

Sand Hill Road has remained relatively conservative into 2010 and 2011.

Some other VC subsets. I used the top 20 venture capitalists in Forbes' Midas List to create a 'smart money' subset of firms. Here are their early-stage deals. The pronounced uptick from the lows in 2008 and 2009 into 2010 and 2011 are heartening.

I also made a subset consisting of firms that have been around since before the 1980s, the 'old school.' I assumed that if they've made it this long, they must be doing something right. Their increase in early stage investments, while less pronounced, is also heartening.

Last, the Super Angels. No surprise here.

The one thing these graphs don't do is support my original thesis, VCs are not slowing down their funding of early-stage companies. Interestingly, I found that even the VCs who have flat-out told me they are slowing down their investing are not really doing so: while there's fear in the market, VCs are also clearly seeing opportunities they can't turn down.

-----

* d3.js is awesome. The Yieldbot guys turned me on to it. I'm just learning it, so I know I'm manhandling it something awful, but it's a joy to work with.

** Let's do the usual caveats: Crunchbase data sucks for this kind of thing. It's incomplete, it's biased, it's not very clean or accurate, etc. This is all completely offset by the fact that it's free. If I had a better dataset, I'd use it, but I don't.

On the slow down comments, usually investment decisions are made a few months (one or two?) before they are announced or added to places like Crunchbase.

ReplyDeleteSo the verbal comments might be a forward indicator of whatever data would appear in say September in the graphs above.

True. Of course, I've been hearing it since January :)

ReplyDeleted3 ninja!

ReplyDeleteNo wonder that round in '09 nearly killed me. Great analysis, thx!

ReplyDeleteNice job Jerry, perhaps more sleepless nights will result in more insights?

ReplyDeleteNice analysis.

ReplyDeleteIt's less powerful than d3.js, but I had a really positive experience with http://highcharts.com/

Jerry, I also stumbled upon the suspicion you had when I looked at average seed stage investment amount and the number of new seed stage deals. There seems to be a sort of pause in Q1 of this year where early stage deal activity and average deal sizes dropped... but both are back in Q2: http://www.ventureexaminer.com/ (last two posts)

ReplyDeleteSorry...just to follow up, your suspicion that traditional VCs slowed down and super angels and corporates picked up activity makes sense based on my analysis because the data I used only includes institutional venture funds. I knew in reality seed and early stage investing was still hot early in the year, but it makes sense that the data shows a drop off if the investments were being made in large part by those not included in the data - super angels and corporates. Hope this makes sense... I think your suspicion was spot on!

ReplyDeleteJerry, I didn't go through the process, but if one were to take your "Sand Hill" cohort and remove your "Midas List" folks from that set (leaving Sand Hill NOT Midas List), seems to me you'll see quite a slow-down. At least no rebound from the '09 trough.

ReplyDeleteGreat visualization. Love it. How did you come up with this list of 150+ VCs?

Jim--

ReplyDeleteInteresting. Of course, Sand Hill Road is just that: firms on Sand Hill Road itself (so, for instance, Accel isn't on the listl even though it exemplifies Sand Hill Road, that's not its address.)

The list of firms is sort of off the top of my head, companies that are or have been active investors during my investing career. Happy to add more. And glad I remembered to include yours :)

Jerry

Thank you for your perspective again :)

ReplyDelete